W-2 and 1099 Year-Round Preview Report

We've released a new report that allows you to preview employee W-2 and 1099 info throughout the year.

OVERVIEW

We’ve released a new report that provides year-to-date totals on Employer Copy D W-2s and Payer Copy C 1099s year round. This will allow payroll administrators to track their employee and company data in real time and catch any errors that may need correction before Q4.

Reports are refreshed nightly and will contain a stamp noting the date of their generation.

ACCESS

Only administrators with the ability to use Namely Payroll can access year-round W-2 and 1099 preview reports.

-

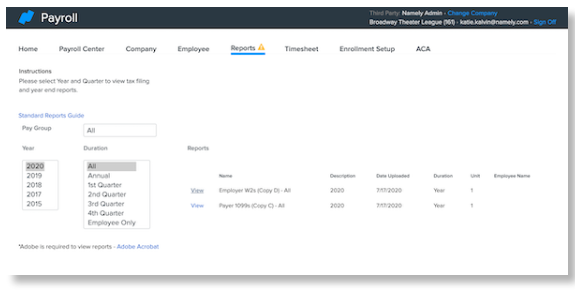

To access the reports, in Payroll, go to Reports > Quarterly and Year End.

-

Select 2020 for the Year.

-

Click either the Employer W2s (Copy D) - All or Payer 1099s (Copy C) - All.

Please note: The W-2s and 1099s contained in these reports should not be used for filing and will contain watermarks noting this. Additionally, they will not display in a “quad” format.

USING THE REPORT

To ensure a seamless and accurate filing, we recommend routine audits of your company’s tax information and submitting any needed corrections before approving your last pay cycle of the quarter. An audit now can save time and money later by avoiding errors that may result in late filing penalties and interest.

We’ve created a Quarter-End Payroll and Tax Validation guide that you can use with the W-2 Preview report to audit your employee and employer tax data and isolate discrepancies in withholding amounts. For more information on audit steps and common errors, read Namely Recommended: Quarter End Payroll and Tax Validation Guide.